YetiSwap Introduction

IntroductionYetiSwap is a decentralized exchange (DEX) which runs on Avalanche, uses thesame automated market-making (AMM) model as Uniswap, features a native governance token called YTS

Introduction

YetiSwap is a decentralized exchange (DEX) which runs on Avalanche, uses the same automated market-making (AMM) model as Uniswap, features a native governance token called YTS that is fully community distributed and is capable of trading all tokens issued on Ethereum and Avalanche. In a crowded marketplace with multiple contenders, YetiSwap offers three critically important benefits: fast and cheap trades, and a fair and open token distribution.

First, YetiSwap can finalize trades quickly and cheaply. Since YetiSwap is built on Avalanche, it enables users to swap assets while enjoying sub-second transaction finality and transaction fees as low as a few cents. Oftentimes, trades on YetiSwap will feel as fast as trades on centralized exchanges. Second, beyond the significant performance upgrades to the technical status quo.

Users of existing AMMs, such as Pangolin, Uniswap, and Sushiswap, are already familiar with their mechanism of action. Therefore, the rest of this post does not discuss how YetiSwap achieves its trading capabilities. Instead, we discuss the YTS token in more detail, including its distribution mechanism and governance rules.

YTS Distribution

We will be community-driven in the future...

Distribution Breakdown

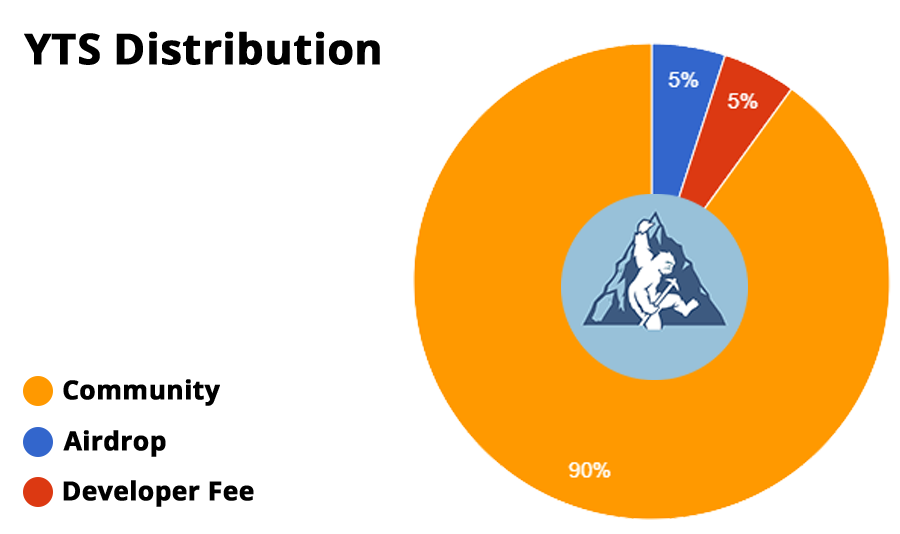

No YTS tokens are allocated to the investors, advisors, or any sort of insiders. YTS is capped at a supply of 556 million tokens, 100% of which will be distributed to the community according to

Chart 1. The first 90% of tokens, or 500 million tokens, are dedicated to the community treasury, where they will initially be used to fund liquidity mining. 5% of tokens, or 28 million tokens, are dedicated to a community airdrop, and 5% of tokens, 28 million tokens, dev fee

Community - Liquidity Mining Allocation (90% of YTS)

The vesting schedule is algorithmically specified as follows: starting from 250 M tokens for the first four years, the number of tokens distributed halves every additional four years, meaning that the next four years contribute roughly a quarter, and so on. This pattern continues into perpetuity. For reference, during the first four years, roughly 5.2 M YTS will be distributed per month to liquidity miners. The full schedule of distribution of YTS in the liquidity mining allocation is shown below:

Time

Total YTS Distributed

YTS / Month

0 - 4 years

250 M

~ 5.2 M

4 - 8 years

125 M

~ 2.6M

8 - 12 years

62.5 M

~ 1.3 M

12 - 16 years

31 M

~ 650 K

16 - 20 years

15.5 M

~ 325 K

20 - 24 years

7.5 M

~ 162 K

24 - 28 years

3.5 M

~ 81 K

...

...

...

Developer Fee (5% of YTS)

Time

Total YTS Distributed

YTS / Month

0 - 4 years

14 M

~ 291 K

4 - 8 years

7 M

~ 145 K

8 - 12 years

3.5 M

~ 72.5 K

12 - 16 years

1.75 M

~ 36 K

16 - 20 years

875 K

~ 18 K

20 - 24 years

437 K

~ 9 K

24 - 28 years

218 K

~ 4.5 K

...

...

...

Community - Airdrop Allocation (5% of YTS)

We will distribute totally 28m YTS on Airdrop in different phases. Details will be announced later...

Last updated